Breaking into a private home is generally a great burden for those affected. Then there is the economic damage. If it is not possible to catch the perpetrator, you will be left with the costs. The same applies if the perpetrator is unable to pay. By taking out insurance, you can protect yourself against economic damage. Household contents insurance covers burglary protection in apartments and houses. You can take out these with various insurers.

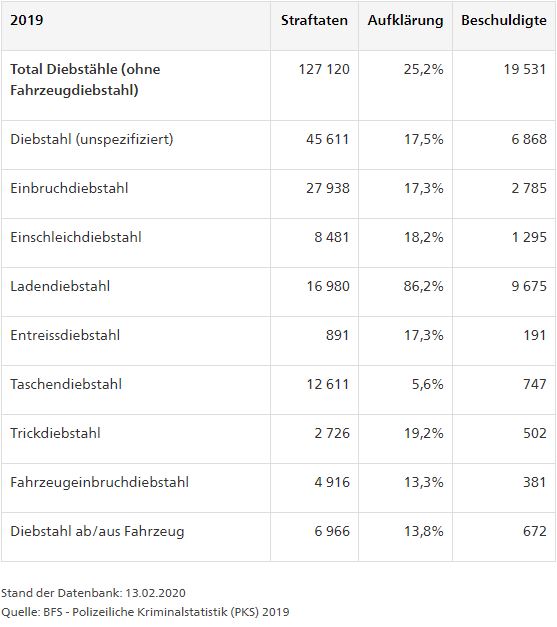

High number of burglaries in Switzerland

Unfortunately, burglaries are very common in Switzerland. In a European comparison, Switzerland has the highest burglary rates. The statistics recorded 2019 cases of burglary or attempts to steal someone else's assets for 36. If it is not possible to determine the perpetrator, you bear the cost loss yourself. In 400, 2019% of all thefts remained unsolved. It is therefore strongly recommended that you take out insurance for burglary protection. However, be aware of the guidelines for taking out such insurance. You will not always be reimbursed for the full value of the stolen property.

Take out insurance for burglary protection

If you would like to insure yourself against a loss of value in the event of a break-in into apartments or houses, take out household contents insurance. If damage occurs, report it to the insurance company immediately. The insurers provide an emergency telephone for this. The insurer will reimburse you for the financial damage. If you are in a tenancy, the landlord pays for the damage to the rented property. Thus, it is his concern for increased Security in the rented apartment to care.

Upper limit for the reimbursement of claims from burglary protection

Note that valuable items may not be fully insured. As a rule, the insurance only reimburses a value of around CHF 20 in the event of an insured event. This is especially true for jewelry, cash, and works of art. If the value of the stolen goods is above this value, you will pay the costs for the replacement yourself.

There are restrictions on claims against the insurance company if you have facilitated access to the apartments through negligence. You shouldn't leave any windows open and repair defective door locks immediately. Otherwise the insurance can reduce your entitlement.

Take out additional insurance for valuables

If you are in possession of valuable items, it is worth taking out additional insurance. The valuables insurance does not only serve as burglary protection. It also applies in the event of loss of or damage to the valuable item.

Increase burglary protection on houses and apartments

You have the option of improving the burglar protection on your building. Install a Alarm system or biometric access controlto prevent assault. One is recommended in stores video surveillance or access controls. This is an effective way of preventing burglaries.

Do you have any questions about insurance or the options for burglary protection? Take it now Contact contact us and arrange a personal consultation. We advise you on the protection provided by the insurance. We also give you important tips on prevention and effective burglary protection in houses and apartments.